Everyone who lives in Australia knows the worst is upon us, the spiraling costs of just about everything, the death of all common optimism, the increasing despair of the nation’s small business owners and the general grumbles about a rapacious tax office destroying any incentive to work hard and get ahead. All the while the public sector expands its remit into all our lives as the government pours billions of dollars into hiring yet more public servants.

One publication has been consistent in its coverage, and that’s MacroBusiness. Leith van Onselen is Chief Economist at the MB Fund and MB Super. He is also a co-founder of MacroBusiness. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs. His news letter is short, punchy and to the point.

Here’s a sampling of recent stories.

Australia’s Miserable Economy

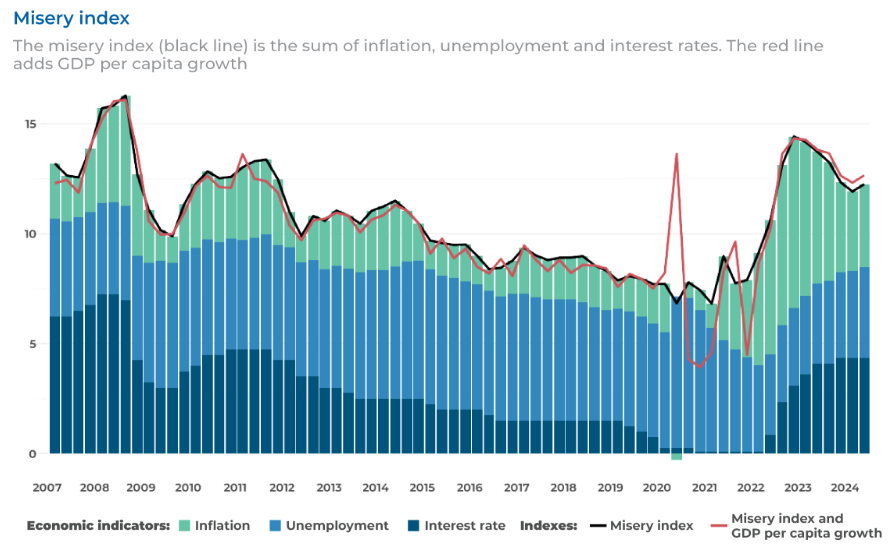

According to new analysis from the Committee for Economic Development of Australia (CEDA), Australians are living through the most protracted period of economic misery since 2011.

Rising inflation has driven around half the rise in the misery index, followed by rising interest rates.

The mood of consumers is certainly miserable, and rightly so. Their living standards have declined for two straight years with no real signs of lifting.

To read the full story go HERE.

Australian small businesses face recession clean-out

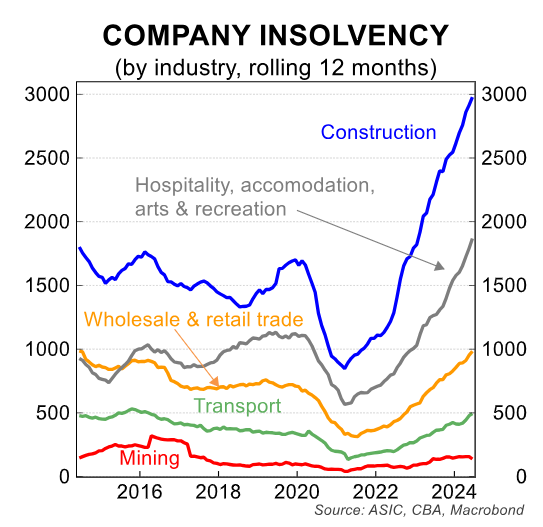

A record number of Australian businesses entered insolvency last financial year, with firms in the construction and hospitality sectors most heavily impacted.

According to data from the Australian Securities and Investments Commission (ASIC), 11,053 companies went into administration in the 2023-24 financial year.

The rate of collapse has continued into this financial year, with ASIC data showing that administrators were appointed to 6,636 companies in the six months to September.

ASIC recorded 3,305 insolvencies in the June quarter and 3,331 in the September quarter, which the Coalition small business minister Sussan Ley says is the worst six-month period on record.

To read the full story go HERE.

The café apocalypse Australia had to have

The accommodation and food services sector saw the highest growth in insolvency appointments of any sector last financial year, increasing by 50% to a record 1667, surpassing the previous high of 1114 in 2023.

Restaurant and Catering Australia CEO Suresh Manickam stated that the hospitality sector was experiencing one of its most difficult periods in history.

“Higher interest rates, cost of living pressures on the up, more expensive produce and the cost of energy are all having an impact”, Manickam said.

“People have less money in their pockets and a reduced ability to pay and go out, and there lies the problem the sector is facing”.

To read the full story go HERE.

Australians suffer world’s biggest collapse in living standards

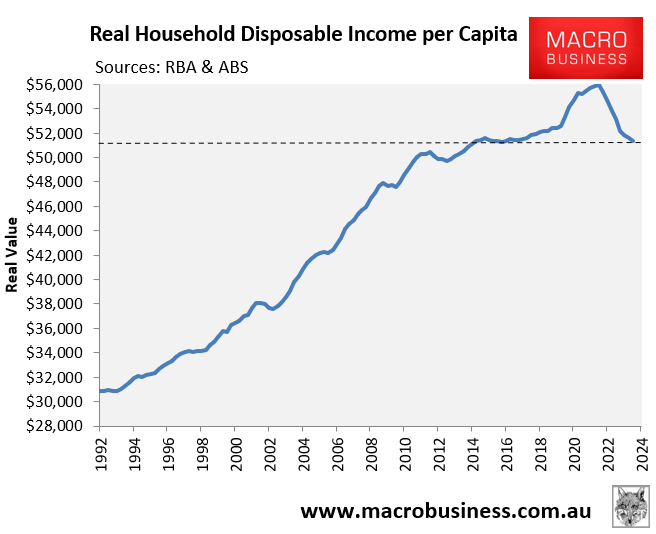

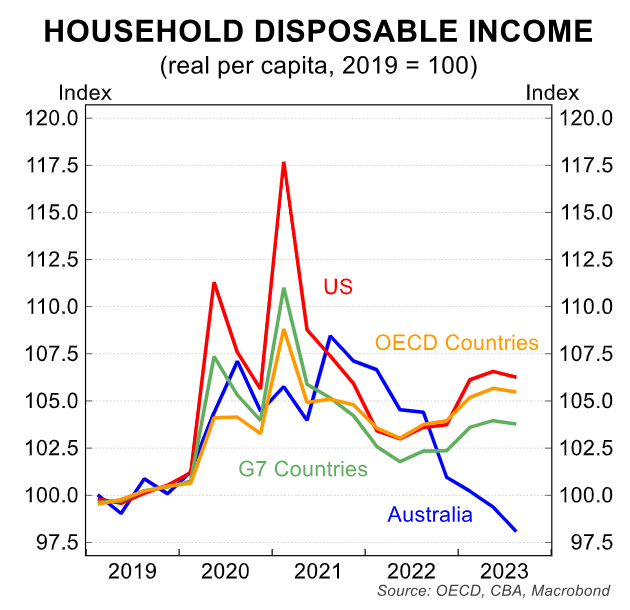

Australian households suffered one of the world’s steepest declines in real per capita household disposable incomes last year.

The March quarter national accounts from the Australian Bureau of Statistics (ABS) showed that annual real per capita household disposable incomes in Australia had collapsed by 7.6% from their June 2022 peak to be tracking at early 2018 levels.

It is a similar story for Australian real wages. When adjusted for headline CPI inflation, Australian real wages are currently tracking 7.1% below their June 2020 peak.

To read the full story go HERE.

1 Pingback